Underwriting

Revision as of 05:59, 2 September 2024 by Hkariuki (talk | contribs) (→Steps to creating accident policy)

Contents

POLICY UNDERWRITING

Underwriting forms the backbone of General Insurance. In AIMS2018, underwriting subsystem is the most voluminous. The subsystem allows all functions that relate to underwriting to be performed.

- New Policy

- Policy Endorsement

- Policy Renewal

- Policy Cancellation

- Policy Reinstatement

MOTOR UNDERWRITING

Steps to Creating a motor policy:

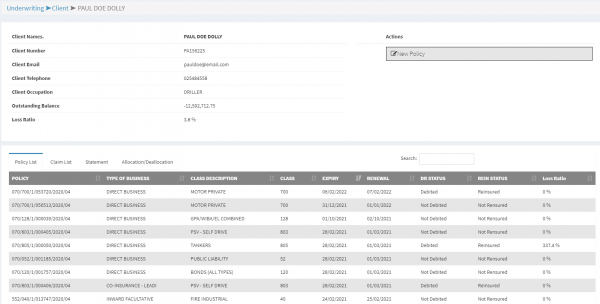

- a. Click on the client link on the sidebar menu.

- b. Click on the +Add Client button and create the client if it is a new client. If the client exists, search and click on the client record or +Policies button to access the client details screen.

- c. Click on the New Policy button to open the policy creation screen below.

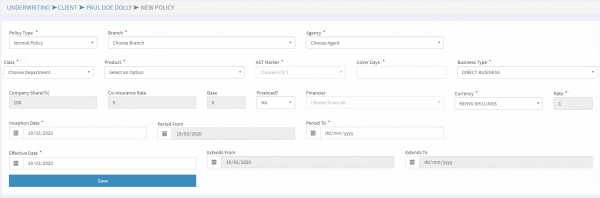

- d. Fill in the required policy details in the policy creation screen as in figure below and submit the details by clicking the Save button to generate the policy number.

- NB: All input fields with red asterisk are mandatory

- e. Select motor department on the Department field. This will display motor classes only on the Class field.

- f. Submitting the form saves the record, generates a policy number and directs you to the risk listing page below.

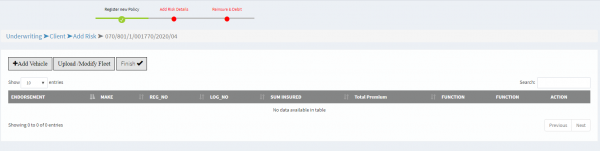

- g. The risk listing page gives you two options: Uploading the motor details or inputting the details yourself.

- i. Uploading motor details

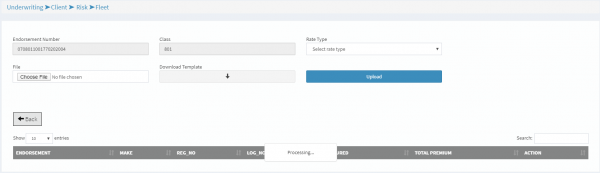

- To upload the motor details, click on the +Upload/Modify Fleet button to access the upload screen. The screen below will be opened.

- Click the Download Template button to download the template required and fill in the motor details as per the template structure.

- Upload the filled document by clicking the Choose File button and selecting the file. Once selected click the Upload button to upload the motor details to the system.

- ii. Inputting motor details

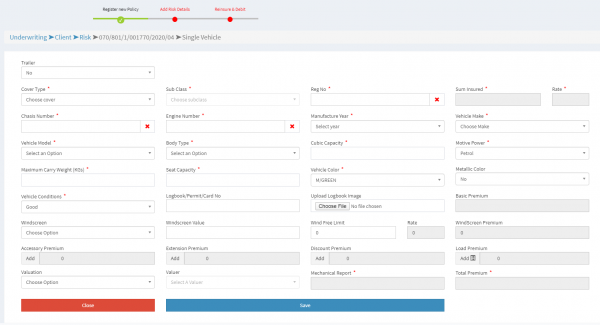

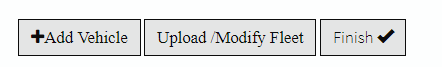

- To capture the motor details manually, click on the +Add Vehicle to access the motor details screen.

- This will open the screen below.

- Fill in the required motor details where fields marked with red asterisk * are mandatory.

- Vehicle Reg No field validates if the registration number already exist in the system and will put a green tick for vehicle registration number that does not exist in the system.

- Click on the Save button to submit the vehicle details. This will redirect back to Risk Listing page.

- h. Click on the Finish button for further processing

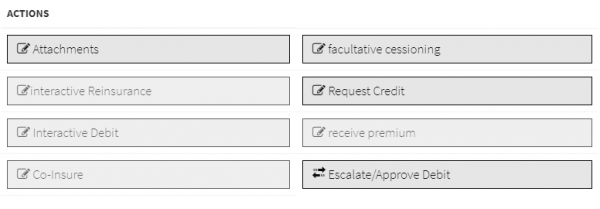

- Further processing that can be done on the policy are:

- i. Express Debiting. This will process Reinsurance as per the set treaty and debit the policy

- ii. Facultative cessioning

- iii. Issue Motor certificate

- iv. Add policy attachments details (Limits, Clauses, Excess and Narration)

- v. Receive Premium. This will generate a Premium receipt automatically.

- vi. Request Credit

- vii. Interractive Reinsurance

- viii. Interractive Debiting

- ix. Capture Co-Insure participants

- x. Escalate/Approve Debit

NON MOTOR UNDERWRITING

Steps to Creating a non motor policy:

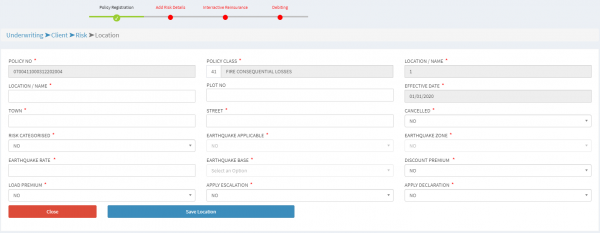

- a) Open the policy registration screen and select a non-motor department e.g. Fire department.

- b) Fill the other details as required and save to generate policy number

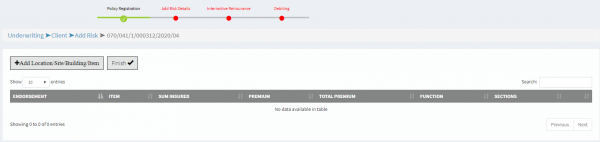

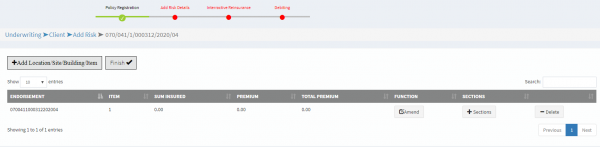

- c) After a successful submission, Add location details screen below will be opened

- d) Click the +Add Location/Site/Building/Item button and add the details. The screen below is opened.

- e) After saving the details, it redirects back to the Add location details screen when you can add more locations/items to the policy.

- f) Click on the added location/site/building/item entry +Section button to open the sections screen

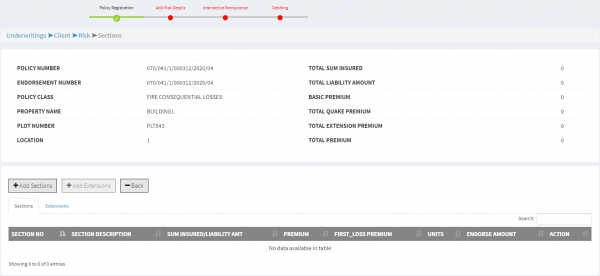

- g) The section(s) screen is opened as shown below

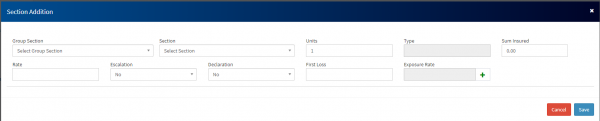

- h) Click on the +Add Sections button to add the section details. A modal screen will be opened as shown below

- i) Add all the section details and press Save button to submit.

- j) Once all the section details have been added, press the –Back button to return to the Location details page.

- k) Repeat steps (f) – (j) if there is more than one location entry

- l) Click on the Finish button for further policy processing.

- m) Further processing that can be done on the policy are:

- i. Interactive Reinsurance

- ii. Interactive Debiting

- iii. Facultative cessioning

- iv. Receive premium

- v. Request Credit

- vi. Add policy Attachments details (Limits, Clauses, Narration)

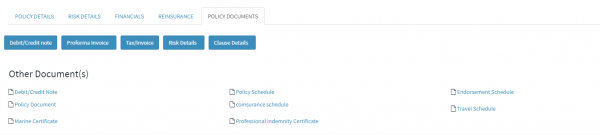

- n) Once policy processing is completed, policy documents can be printed from the POLICY DOCUMENTS tab.

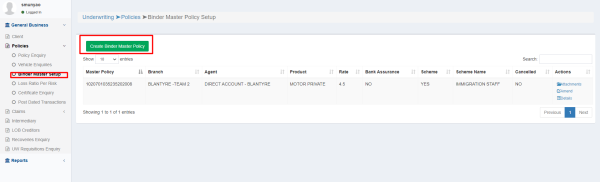

BINDER/SCHEME POLICY PROCESSING

Binder/Scheme Master Policy

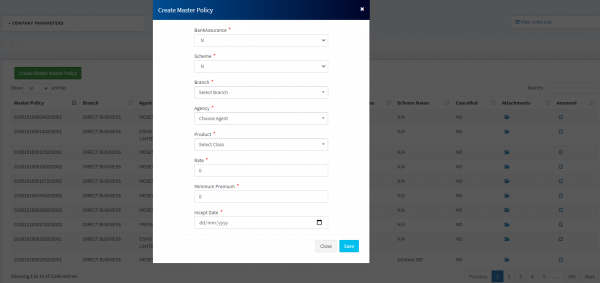

When creating a Binder/Scheme policy, you first need to create a Master policy. Authorized user will access the binder/scheme master policy link.

Create a Master Binder/Scheme policy using the screen below by selecting the required fields marked with an asterisk *.

Binder/Scheme Policy Underwriting

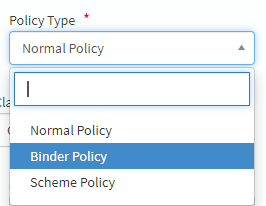

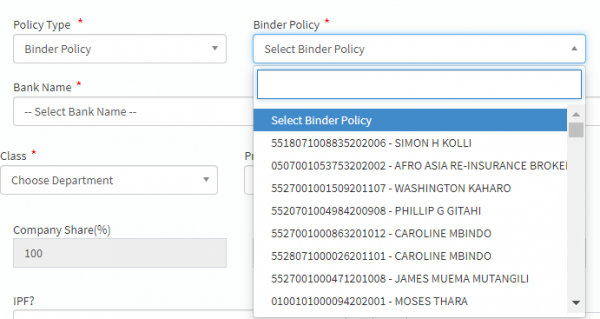

- On the New Policy screen, select Binder/Scheme Policy type

- Binder/Scheme master policy field appears. Select master policy to use by searching in the drop down field. Click on the selected policy. The selected master policy auto populates Branch, Agency, Class and Product fields as set in the master policy.

GROUP PERSONAL ACCIDENT/FIDELITY GUARANTEE PROCESSING

Steps to creating accident policy

- Click on the client link on the side bar menu

- Select the client you wish to underwrite on, create a new client by clicking on the +Add client if the client exists.

- Click on the New Policy to open the policy registration screen.

- Fill in the details as required anf click on save to generate the policyand policy number

- After successful creation of the group personal accident you'll be presented on the screen below

- We'll start off by captring the Accident Details of the policy

- The Basis of cover is split into 2- Categories and Blanket Cover.

- Category cover will enable the underwriter to capture a group of personal accident which covers the various catgories in the client's organisation e.g, CEO, CFO, COO etc.

- Blanket cover on the other hand is turned to capture details of all employees regardless of the position/category.

- The Basis of Rating is also split into 2-Multiple of Earning and Fixed Benefits.

- When you select multiple of earnings, you can select the multiplier(years) from the 'Multiple of Earnings as shown below

- When you choose Fixed Benefits as the basis of rating, the fields below will not be active, since the are only used on Multiple of Earnings.

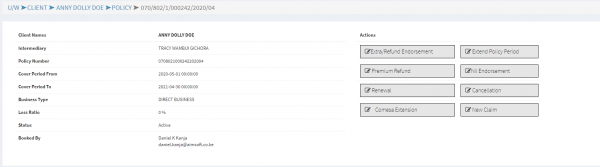

POLICY ENDORSEMENT

- Extra/Refund

- Extend Policy Period

- Premium Refund

- Nil

Access Endorsement Buttons

- Select the appropriate Endorsement button to proceed.

- This generates an endorsement document number, which is used in the endorsement process.

- Changes are made where appropriately and the system calculates the new annual premium based on any changes made. The difference between the new annual premium and previous annual premium is prorated based on the endorsement date to calculate the endorsement premium that will be debited.

Policy Renewal

- Use Renewal button to register and process a policy renewal.

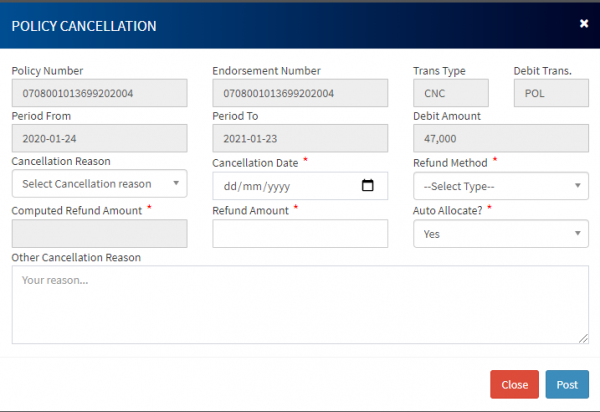

Policy Cancellation

- Use Cancellation button to cancel a policy.

- Cancellation screen pops up as shown below. Select the Cancellation reason, Cancellation Date, Refund method to be used, Amount to be refunded and Other cancellation reason description.