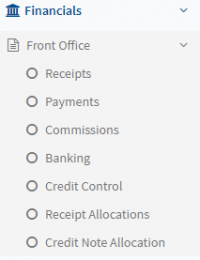

Front office

Contents

FRONT OFFICE CASHBOOK

The Front Office System is a cashbook system that incorporates online payments, Receipting and bank reconciliation. This module boasts of tight integration with other AIMS systems especially in the areas of underwriting and claims

RECEIPTS

- a) Click on the Receipts link on the sidebar, this opens the receipting page with the following options:

- i. Issue New Receipt

- ii. Issue Cash Call Receipt

- iii. Issue Receipt to Knock off Credit

- iv. Existing Receipts listing

Figure 9 Receipts page

- b) Click on an existing receipt entry to view the Receipt details as shown below. This allows for Receipt Printing and Receipt Reversal.

Figure 10 Receipt Details page

- c) Click on the Issue New Receipt button to generate a new receipt.

Figure 11 Receipt buttons

- d) Fill in the required receipt details as shown below and press the save button to submit details.

Figure 12 New Receipt screen

- e) Premium Receipt type will give an option to type and select client policy details as captured in underwriting. This allows for selection of outstanding debit notes for the selected client and auto fill the required policy details such as client name and intermediary account.

Figure 13 Premium Receipt creation

- f) Click Issue Cash Call Receipt button to open Cash Call Receipt screen below.

Figure 14 Cash Call Receipt

- g) Click Issue Receipt to Knock off Credit button to open the screen below

Figure 15 Issue receipt to knock off credit screen

PAYMENTS

- a) Click payments link to access the payments page as shown below with the following options:

- i. Un-posted Requisitions

- ii. Multi-Requisition Voucher

Figure 16 Payments page

- b) Click on a payment entry to access the payment voucher details.

Figure 17 Payment voucher details

- c) Click Unposted Requisitions button to create a new requisition. This open the page below with New Requisition button.

Figure 18 Unposted Requisitions

- d) Click on a requisition entry to display the requisition details

Figure 19 Requisition details

- e) Click the New Requisition button to open the requisition screen below.

Figure 20 New Requisition screen

- f) After a requisition is saved successfully, further action can be processed as below

- i. Cancel requisition

- ii. Amend requisition

- iii. Add requisition documents

- iv. Authorize payment

- v. Approve requisition

- vi. Post Payment voucher

Figure 21 Requisition Actions

COMMISSIONS

- a) Click on the Commissions link to access commissions processing page as shown below with the following options

Generate commissions Generate commission Batches & Requisition

Figure 22 Commissions Processing

- b) Click on Generate Commissions button to select commission processing period. Input the required Year and Month then press Generate button.

Figure 23 Commission processing period

- c) Click on the Generate Commission Batches & Reqs button to generate commission batch and process a payment requisition for the generated batch

Figure 24 Generate Commission Batches

- d) Select Generate Per Branch, Agent or All. This allows to group and mark items to be paid or not to be paid.

BANKING

- a) Click on the Banking link to access Bank management and reconciliation page as shown below.

Figure 25 Banking

- b) Click on a Bank entry to access the bank details and related bank transactions as shown below

Figure 26 Bank Details

CREDIT CONTROL

- a) Click on the Credit Control link to access credit request posted as shown below

Figure 27 Credit Request

- b) Click on a credit entry to display the credit request details and further actions to be done on the entry as shown below. Actions to be done include

- i. Print Credit Request

- ii. Cancel Credit Request

- iii. Approve Credit Request