Difference between revisions of "Financials"

| Line 148: | Line 148: | ||

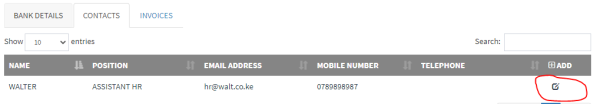

To edit vendor contacts, click Edit button | To edit vendor contacts, click Edit button | ||

[[File:41.png|600px|thumb|center|New Policy Button]] | [[File:41.png|600px|thumb|center|New Policy Button]] | ||

| + | |||

| + | ===b)Vendor Invoices=== | ||

| + | To view all vendor invoices, go to Financials, Acounts Payables then click on Vendor Invoices | ||

Revision as of 07:28, 12 September 2024

A) ACCOUNTS PAYABLES

Contents

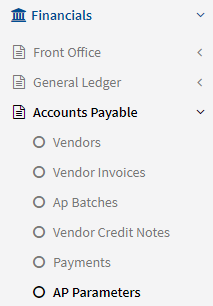

a) AP Parameters

Go to Financials-> Accounts Payable -> AP Parameters

Under AP Parameters, the contents are:

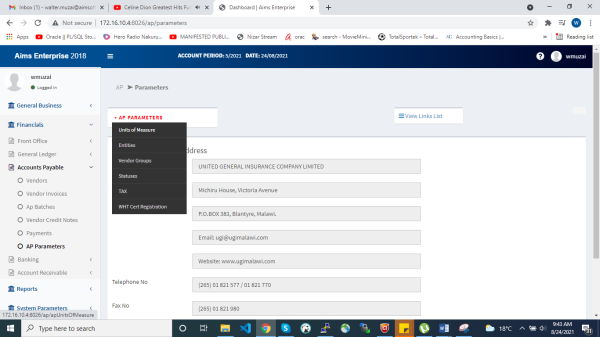

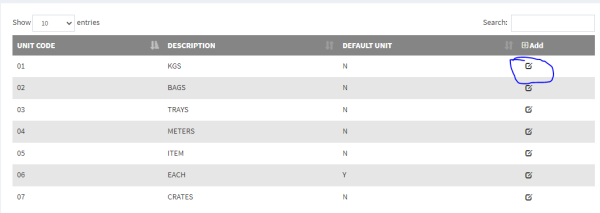

i)Units of Measure

These are the units of measure for invoice items. To Set up the the units of measure, click on Units of Measure Then Click on add button

Fill the form and click Save

To edit, click on the edit button, fill the form and click update

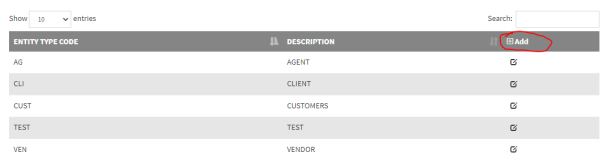

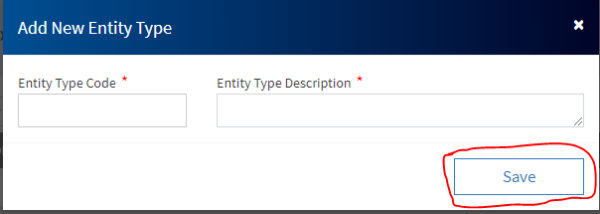

ii)Entities

To Set up the Entities, click on Entities Then Click on add button

Fill the form and click Save

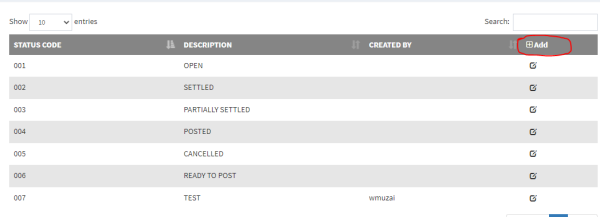

iii)Statuses

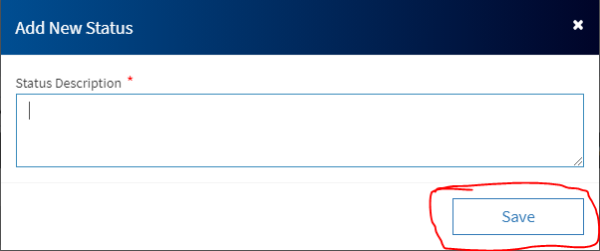

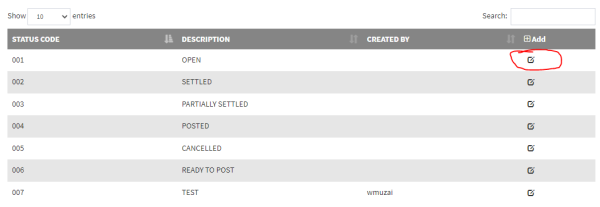

To Set up the Statuses, click on Statuses Then Click on add button on the table with statuses

Fill the form and click click save to submit

To edit a status description, click on the edit button

Fill in the status description and click update

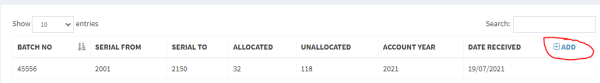

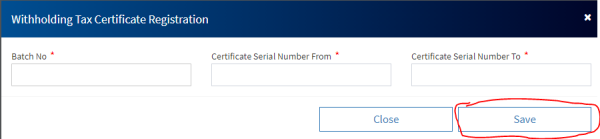

iv)WHT Cert Registration

This is where the Withholding Tax Certificate numbers are captured To register new certificate serials, click on WHT Cert Registration, the click on the ADD button on the table.

Fill the form and click save to submit

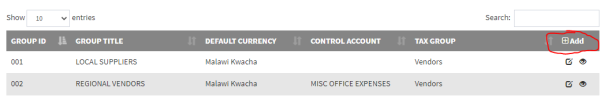

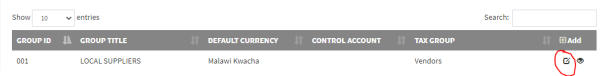

v)Vendor Group

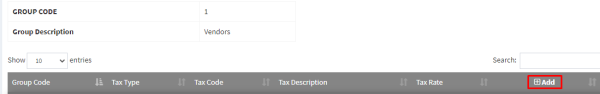

Click on Vendor groups menu On the table, click on the ADD button

To edit vendor group, click on the edit button, fill the form and click on the update button to complete the edit

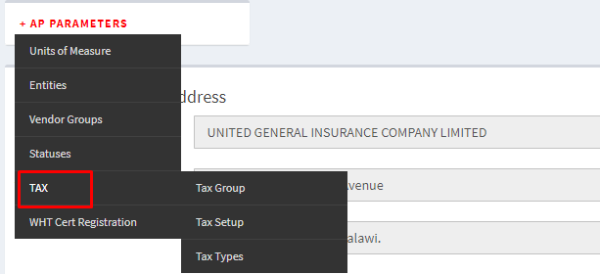

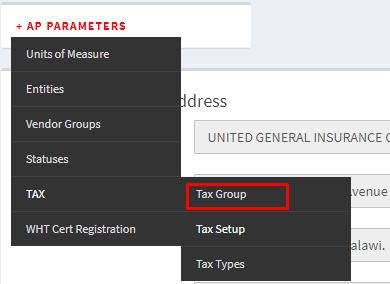

Taxes

Hover the mouse over tax

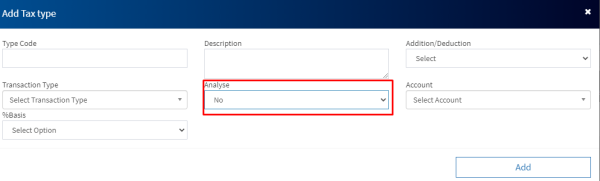

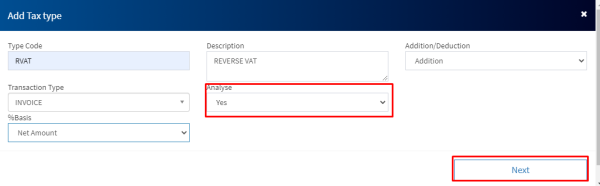

Step 1:Tax types set up

Click on Tax types To add a tax type, click on ADD button

If the tax type transaction goes into one account, select analyse No

If there are different control accounts for different transaction on a specific tax type, select analyse Yes, then click next button

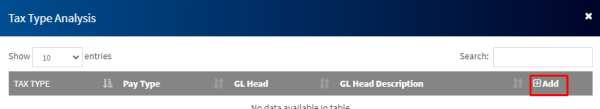

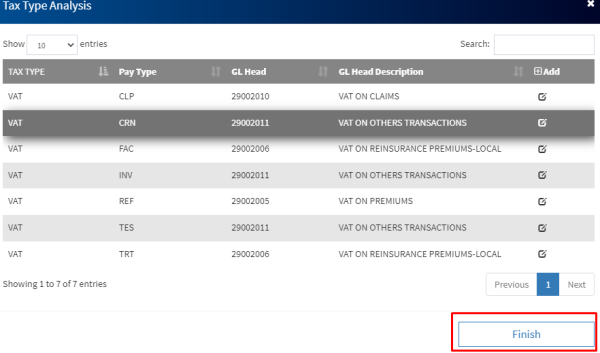

Click Add button to add a tax type account for different transaction type

Click Finish button to complete the set up

Step 2:Taxes group set up

Click on Tax Setup Then click on Add button

Fill the form then submit

Step 3: Tax group setup To Set up AP Tax groups, Click on Tax Groups

Click on Add button

Editing the tax group

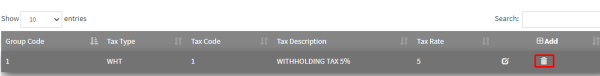

To add tax types to the tax group, click on

Add tax types to tax group – Click on ADD button

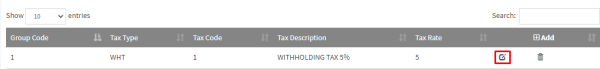

To remove a tax type from tax group, click on

To edit

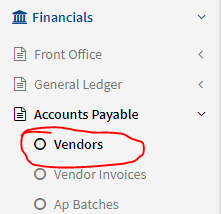

b)Vendors

To create a new vendor, go to Financials, Acounts Payables the click on Vendors

Then click on Add Vendor button

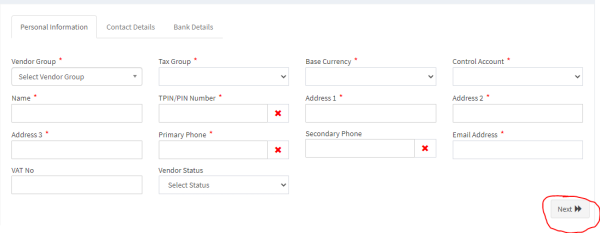

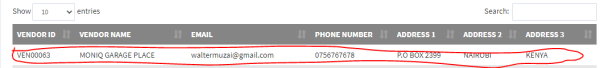

Fill the vendor form then click NEXT To view Vendor details, click anywhere within the row on the vendors table

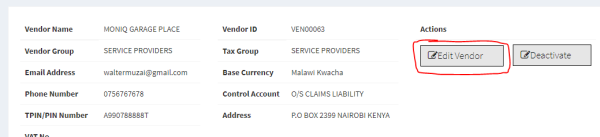

To view vendor details, click on the Edit Vendor button

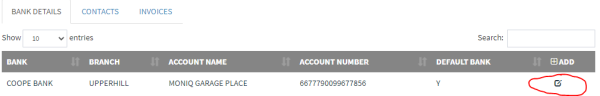

To edit the bank details, click on the Edit Vendor button

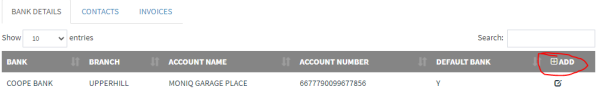

To add vendor vendor banks, click ADD button on the banks table

To edit the bank details, click on the edit button

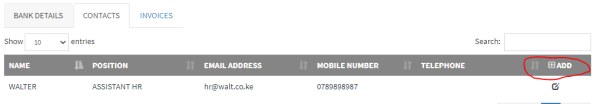

To add vendor contact people, click ADD button on the contacts table

To edit vendor contacts, click Edit button

b)Vendor Invoices

To view all vendor invoices, go to Financials, Acounts Payables then click on Vendor Invoices