Difference between revisions of "Underwriting"

Jump to navigation

Jump to search

| Line 13: | Line 13: | ||

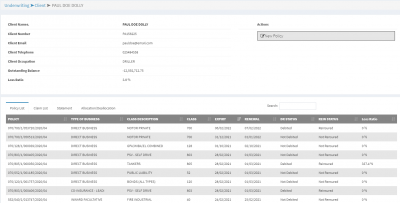

* c. Click on the '''New Policy''' button to open the policy creation screen below. | * c. Click on the '''New Policy''' button to open the policy creation screen below. | ||

| − | [[File:Newpolicyform.png|400px|thumb| | + | [[File:Newpolicyform.png|400px|thumb|center|New Policy Button]] |

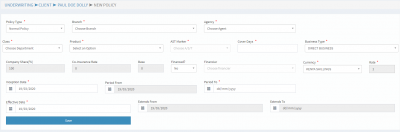

* d. Fill in the required policy details in the policy creation screen as in figure below and submit the details by clicking the Save button to generate the policy number. | * d. Fill in the required policy details in the policy creation screen as in figure below and submit the details by clicking the Save button to generate the policy number. | ||

| Line 20: | Line 20: | ||

* f. Submitting the form saves the record, generates a policy number and directs you to the risk listing page below. | * f. Submitting the form saves the record, generates a policy number and directs you to the risk listing page below. | ||

| − | [[File:Addvehicle.png|400px|thumb| | + | [[File:Addvehicle.png|400px|thumb|center|Add Vehicle page]] |

* g. The risk listing page gives you two options: Uploading the motor details or inputting the details yourself. | * g. The risk listing page gives you two options: Uploading the motor details or inputting the details yourself. | ||

| Line 26: | Line 26: | ||

:To upload the motor details, click on the '''+Upload/Modify Fleet''' button to access the upload screen. The screen below will be opened. | :To upload the motor details, click on the '''+Upload/Modify Fleet''' button to access the upload screen. The screen below will be opened. | ||

| − | [[File:Uploadfleet.png|400px|thumb| | + | [[File:Uploadfleet.png|400px|thumb|center|Upload Fleet Page]] |

:Click the Download Template button to download the template required and fill in the motor details as per the template structure. | :Click the Download Template button to download the template required and fill in the motor details as per the template structure. | ||

| Line 36: | Line 36: | ||

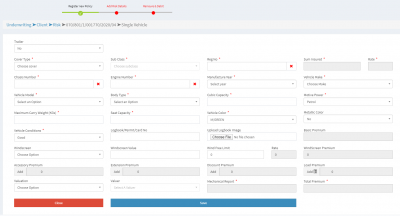

:Fill in the required motor details where fields marked with red asterisk * are mandatory. | :Fill in the required motor details where fields marked with red asterisk * are mandatory. | ||

| − | [[File:Vehicledetails.png|400px|thumb| | + | [[File:Vehicledetails.png|400px|thumb|center|Vehicle details Form]] |

Vehicle '''Reg No''' field validates if the registration number already exist in the system and will put a green tick for vehicle registration number that does not exist in the system. | Vehicle '''Reg No''' field validates if the registration number already exist in the system and will put a green tick for vehicle registration number that does not exist in the system. | ||

| Line 42: | Line 42: | ||

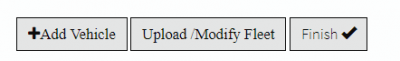

* h. Click on the Finish button for further processing | * h. Click on the Finish button for further processing | ||

| − | [[File:Vehiclefinish.png|400px|thumb| | + | [[File:Vehiclefinish.png|400px|thumb|center|Vehicle Finish button]] |

:Further processing that can be done on the policy are: | :Further processing that can be done on the policy are: | ||

| Line 51: | Line 51: | ||

::v. Receive Premium. This will generate a Premium receipt automatically. | ::v. Receive Premium. This will generate a Premium receipt automatically. | ||

::vi. Request Credit | ::vi. Request Credit | ||

| − | ::vii. | + | ::vii. Interractive Reinsurance |

| − | ::viii. | + | ::viii. Interractive Debiting |

::ix. Capture Co-Insure participants | ::ix. Capture Co-Insure participants | ||

| + | ::x. Escalate/Approve Debit | ||

Revision as of 09:55, 19 March 2020

POLICY UNDERWRITING

Underwriting forms the backbone of General Insurance. In AIMS2018, underwriting subsystem is the most voluminous. The subsystem allows all functions that relate to underwriting to be performed.

MOTOR UNDERWRITING

Steps to Creating a motor policy:

- a. Click on the client link on the sidebar menu.

- b. Click on the +Add Client button and create the client if it is a new client. If the client exists, search and click on the client record or +Policies button to access the client details screen.

- c. Click on the New Policy button to open the policy creation screen below.

- d. Fill in the required policy details in the policy creation screen as in figure below and submit the details by clicking the Save button to generate the policy number.

- NB: All input fields with red asterisk are mandatory

- e. Select motor department on the Department field. This will display motor classes only on the Class field.

- f. Submitting the form saves the record, generates a policy number and directs you to the risk listing page below.

- g. The risk listing page gives you two options: Uploading the motor details or inputting the details yourself.

- i. Uploading motor details

- To upload the motor details, click on the +Upload/Modify Fleet button to access the upload screen. The screen below will be opened.

- Click the Download Template button to download the template required and fill in the motor details as per the template structure.

- Upload the filled document by clicking the Choose File button and selecting the file. Once selected click the Upload button to :upload the motor details to the system.

- ii. Inputting motor details

- To capture the motor details manually, click on the +Add Vehicle to access the motor details screen.

- This will open the screen below.

- Fill in the required motor details where fields marked with red asterisk * are mandatory.

Vehicle Reg No field validates if the registration number already exist in the system and will put a green tick for vehicle registration number that does not exist in the system. Click on the Save button to submit the vehicle details. This will redirect back to Risk Listing page.

- h. Click on the Finish button for further processing

- Further processing that can be done on the policy are:

- i. Express Debiting. This will process Reinsurance as per the set treaty and debit the policy

- ii. Facultative cessioning

- iii. Issue Motor certificate

- iv. Add policy attachments details (Limits, Clauses, Excess and Narration)

- v. Receive Premium. This will generate a Premium receipt automatically.

- vi. Request Credit

- vii. Interractive Reinsurance

- viii. Interractive Debiting

- ix. Capture Co-Insure participants

- x. Escalate/Approve Debit