Difference between revisions of "Underwriting"

Jump to navigation

Jump to search

| Line 5: | Line 5: | ||

==MOTOR UNDERWRITING== | ==MOTOR UNDERWRITING== | ||

| − | Steps to Creating a motor policy: | + | ===Steps to Creating a motor policy:=== |

* a. Click on the <u>'''client link'''</u> on the sidebar menu. | * a. Click on the <u>'''client link'''</u> on the sidebar menu. | ||

* b. Click on the '''+Add Client''' button and create the client if it is a new client. If the client exists, search and click on the '''client record''' or '''+Policies''' button to access the client details screen. | * b. Click on the '''+Add Client''' button and create the client if it is a new client. If the client exists, search and click on the '''client record''' or '''+Policies''' button to access the client details screen. | ||

Revision as of 17:41, 21 March 2020

Contents

POLICY UNDERWRITING

Underwriting forms the backbone of General Insurance. In AIMS2018, underwriting subsystem is the most voluminous. The subsystem allows all functions that relate to underwriting to be performed.

MOTOR UNDERWRITING

Steps to Creating a motor policy:

- a. Click on the client link on the sidebar menu.

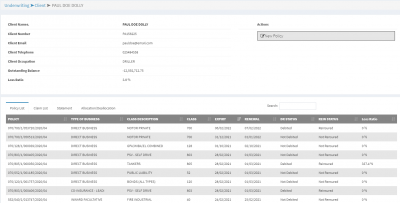

- b. Click on the +Add Client button and create the client if it is a new client. If the client exists, search and click on the client record or +Policies button to access the client details screen.

- c. Click on the New Policy button to open the policy creation screen below.

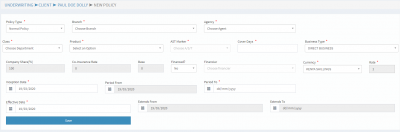

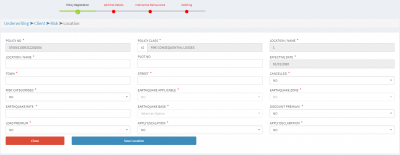

- d. Fill in the required policy details in the policy creation screen as in figure below and submit the details by clicking the Save button to generate the policy number.

- NB: All input fields with red asterisk are mandatory

- e. Select motor department on the Department field. This will display motor classes only on the Class field.

- f. Submitting the form saves the record, generates a policy number and directs you to the risk listing page below.

- g. The risk listing page gives you two options: Uploading the motor details or inputting the details yourself.

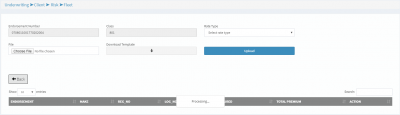

- i. Uploading motor details

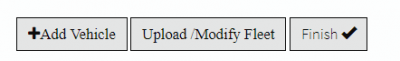

- To upload the motor details, click on the +Upload/Modify Fleet button to access the upload screen. The screen below will be opened.

- Click the Download Template button to download the template required and fill in the motor details as per the template structure.

- Upload the filled document by clicking the Choose File button and selecting the file. Once selected click the Upload button to :upload the motor details to the system.

- ii. Inputting motor details

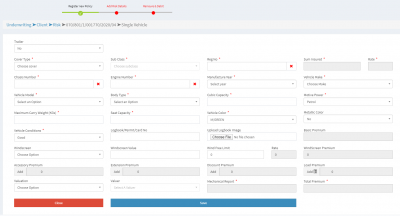

- To capture the motor details manually, click on the +Add Vehicle to access the motor details screen.

- This will open the screen below.

- Fill in the required motor details where fields marked with red asterisk * are mandatory.

- Vehicle Reg No field validates if the registration number already exist in the system and will put a green tick for vehicle registration number that does not exist in the system.

- Click on the Save button to submit the vehicle details. This will redirect back to Risk Listing page.

- h. Click on the Finish button for further processing

- Further processing that can be done on the policy are:

- i. Express Debiting. This will process Reinsurance as per the set treaty and debit the policy

- ii. Facultative cessioning

- iii. Issue Motor certificate

- iv. Add policy attachments details (Limits, Clauses, Excess and Narration)

- v. Receive Premium. This will generate a Premium receipt automatically.

- vi. Request Credit

- vii. Interractive Reinsurance

- viii. Interractive Debiting

- ix. Capture Co-Insure participants

- x. Escalate/Approve Debit

NON MOTOR UNDERWRITING

- a) Open the policy registration screen and select a non-motor department e.g. Fire department.

- b) Fill the other details as required and save to generate policy number

- c) After a successful submission, Add location details screen below will be opened

- d) Click the +Add Location/Site/Building/Item button and add the details. The screen below is opened.

- e) After saving the details, it redirects back to the Add location details screen when you can add more locations/items to the policy.

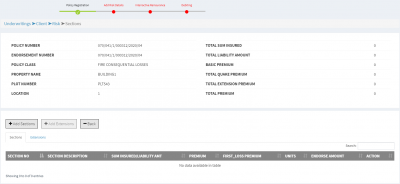

- f) Click on the added location/site/building/item entry +Section button to open the sections screen

- g) The section(s) screen is opened as shown below

- h) Click on the +Add Sections button to add the section details. A modal screen will be opened as shown below

- i) Add all the section details and press Save button to submit.

- j) Once all the section details have been added, press the –Back button to return to the Location details page.

- k) Repeat steps (f) – (j) if there is more than one location entry

- l) Click on the Finish button for further policy processing.

- m) Further processing that can be done on the policy are:

- i. Interactive Reinsurance

- ii. Interactive Debiting

- iii. Facultative cessioning

- iv. Receive premium

- v. Request Credit

- vi. Add policy Attachments details (Limits, Clauses, Narration)

- vii. Cancel an Endorsement

- n) Once policy processing is completed, policy documents can be printed from the POLICY DOCUMENTS tab.